Tax Exemption on International Call Center FBR

Tax Exemption on International Call Center FBR

If you are running a international call center business you only pay fixed final tax.A special regime u/s 154A for export of IT and IT enabled services was introduced through Finance Act, 2021 whereby 1% final tax was collected on realization of export proceeds of these services

Export proceeds of Computer software or IT services or IT Enabled services by persons registered with Pakistan Software Export Board 0.25% of proceeds

Moreover, provisions of Tenth Schedule will not apply on tax collectible under section 154A of the Ordinance. Necessary change has been incorporated in rule 10 of Tenth Schedule in this regard Tax Exemption on International Call Center FBR

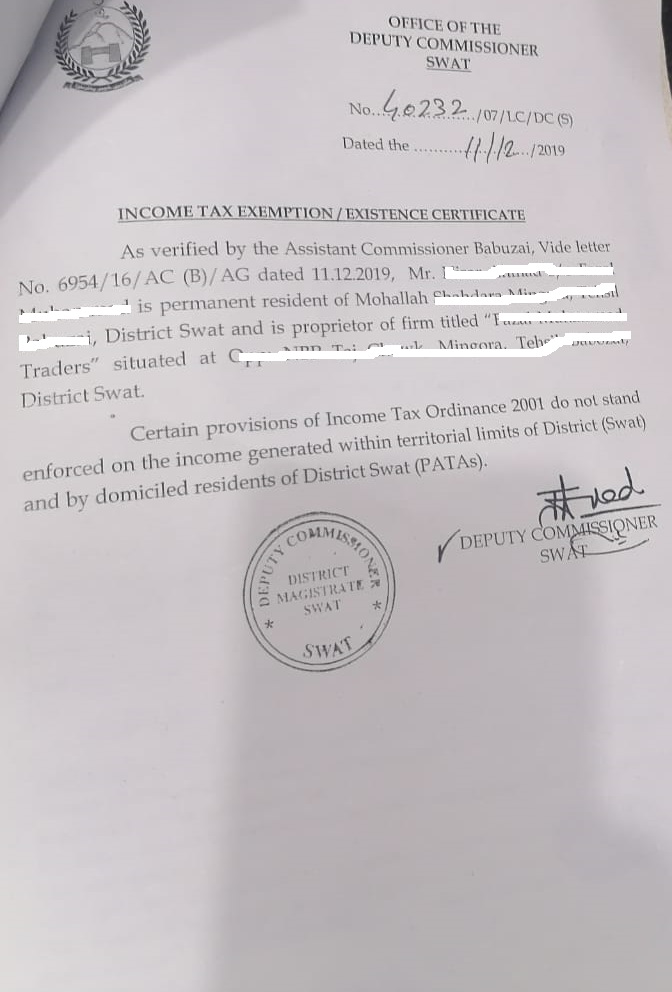

Income Tax Exemption SWAT

Income Tax Exemption SWAT & Income Tax Exemption FATA & PATA

If you are a resident of Swat and you are running a business there, no income tax is applicable. However, you are required to obtain an income tax exemption certificate in Swat.

If you need income tax exemption certficate feel free to contact us

Company Registration In Islamabad

Company Registration In Islamabad

If you want to register a company in Islamabad, Astro Associates is the best tax consultants and company registration service provider

What Information & Dcouments Required for Company Registartion?

- CNIC

- E-Mail Id & Mobile

- Office Address

- Company Name

- Nature of Work

- Share Capital

- CEO & Share distribution

How Many Days Required to Reserved the name in SECP?

1 working day required for name reservation confirmation

How Many Days Required for Company Registration?

Minimum 1 and Maximum 3 working days required to compelte the Company registration process.

If we Registar a company thorugh Combine Proces?

If you register a company in SECP through combine process then it will take maximum two working days to register a company.

We are best in Company Registration In Islamabad

How to Register Subsidiary Foreign Company in Pakistan

How to Register Subsidiary Foreign Company in Pakistan?If you want to make branch office or liason office following documents and requirments

Following Document required

- Passport

- Pakistani Visa

- Current address of Directors in Pak

- Permanent Address in China

- Email Id and mobile numbers of each Directors

- company latest documents AOA,AOM,Annual renewal forms (that should be attested from Notary Public & Embassy of Pakistan)

- Board resolution for name reservation

- Authorization from company to present directors in Pakistan

Following Info Required

- Office Address in Pakistan

- Who will be the ceo

- What will be the share percentages & Minimum two directors required

- For company dedicated email Id and mobile in Pak

If you need any help How to Register Subsidiary Foreign Company in Pakistan astro associates is the best consultant to Register Subsidiary Foreign Company in Pakistan

How to register Company in SECP eZfile

How to register Company in SECP eZfile

After 14th feb 2024 process of submission is chanaged.Now you can register your company in secp through eZfile website.

Following Document & Info Required

- Company Name

- Nature of Work

- Registered Address

- Directors Mobile & Email id (Mobile number should be at his name)

- Share percentage

- CEO

Sign Up

First Step is sign up process here you will enter your id card number,expiry date,date of birth.After this you will enter Mobile number after enering code you will add email id after entering email id code you will receive password protected pin in email id.Your registartion password will use to open this pin pdf

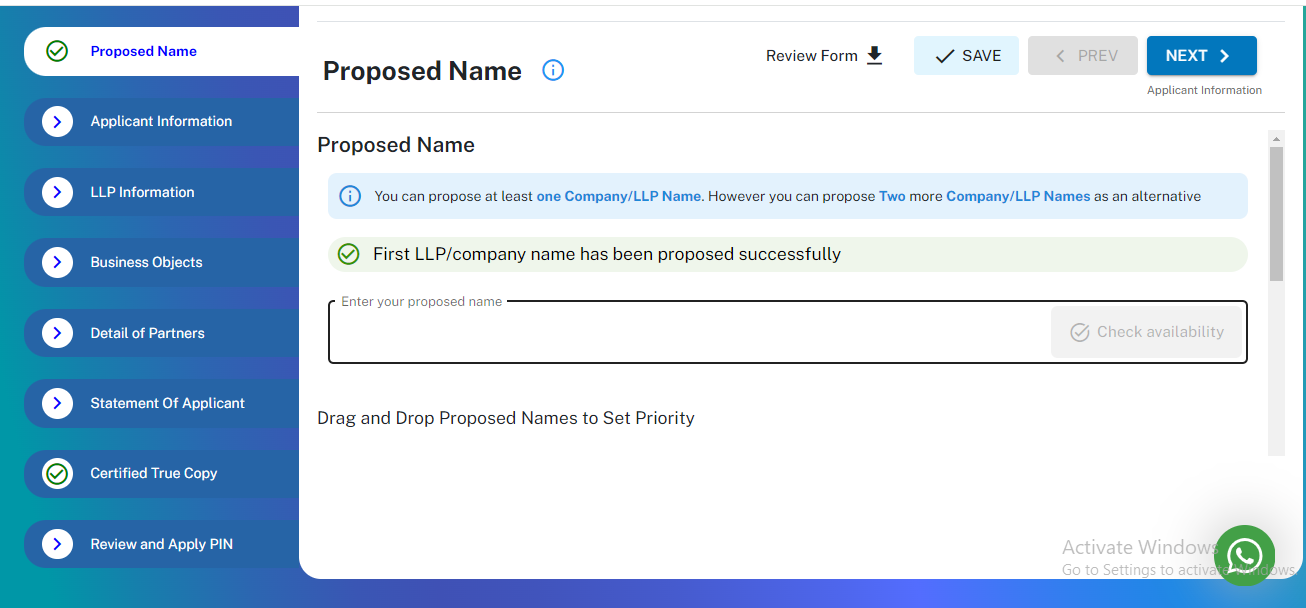

Name Reservation

Please select name reservation application type

- Reservation of name for incorporation of a new llp/company

- Combined Name Reservation & Incorporation

- Reservation of name for change of name of existing llp/company

You have three option one only name reservation and 2nd name reservation and company registraion and 3rd if you wish to change the reserved name

If you are single member select Single Member Company

if you are more then one select Private Company

after reserving the name pay fee

Company Registration

After name reservation you will see the incorporation process fill the forms

- Applicant information

- Company Information

- Business Objectives

- Details of directors

- Reveiw and apply pin (All directors must have login id password & Pin) with pin

If you need any help How to register Company in SECP eZfile we can assist you feel free to contact us.Astro Associates Islamabad is the best tax consultants and company registration services company.

Tax Consultants in Pakistan

Tax Consultants in Pakistan

Astro Associates best Tax Consultants in Pakistan in following Services

Income Tax Filing Services in Islamabad,Pakistan

Sales Tax Filing Services in Islamabad,Pakistan

Company Tax Filing Services in Islamabad,Pakistan

Individual Tax Filing Services in Islamabad,Pakistan

How to cancel or Delete the National Tax Number in Pakistan?

How to cancel or Delete the National Tax Number in Pakistan?

If you are leaving country or person is dead then you can cancel or delete your NTN.

- Application for cancel or Delete the National Tax Number to fbr

- Last Tax Retrun

For example if a perosn died or leave country by 14th Nov 2024 then he will file his tax retrun of Fy-2024 and report for six month this will be his last tax retrun.

If you want to close or delete your NTN Astro Associates can help you to close NTN in Pakistan

COMPARISON OF EXISTING AND NEW FORMS SECP UNDER THE COMPANIES REGULATIONS, 2024

The company registry part of the upcoming LEAP program consists of several phases. The existing eServices has been replaced with a new portal namely “eZfile”. The first phase i.e. registration of Limited liability Partnerships has been launched on June 22, 2023. The second Phase involves certain processes for filing of returns by the Limited Liability Companies, which is going to be launched on February 15, 2024. The remaining processes shall be launched in the next phase.

For the convenience of users, a comparison of existing and new forms to be filed under various regulations and its filing mode is given below:

- Companies (General Provisions and Forms) Regulations, 2018

| Sr. No |

Existing Form No.

|

New Form No. in Companies Regulations, 2024

|

Remarks |

Mode of Filing

(eZfile / eServices / Manual) |

|

| After launch of LEAP, following forms would be filed under “eZfile” Portal | After launch of LEAP, following forms would be filed under existing “eService” Portal | ||||

|

1

|

Form-A

(Annual return of company having share capital) |

Form A

(Annual return of a company) |

A Combined Form has been developed for existing Form-A, Form-B & Form-D. | eZfile |

–

|

|

2

|

Form-B (Annual return of company not having share capital) |

Abolished

|

Merged into Form-A | – | – |

|

3 |

Form-D (Annual return of inactive company) |

Abolished

|

Merged into Form-A | – | – |

|

4 |

Form-C

(Annual return of companies in case there is no change of particulars since last annual return filed with the registrar) |

Form 24

(Annual return of companies in case there is no change of particulars since last Annual Return filed with the Registrar) |

Form Number has been changed. | eZfile | – |

| 5 | Form 1 with Appendix (Receipt of subscription money) | Abolished | Form 1 regarding receipt of subscription money has been abolished after amendments in Companies Act. | – | – |

| 6 |

Form 2

(Application for conversion of status of company) |

Abolished

|

Abolished | Relevant Forms to be filed for conversion of status i.e. Form-26, Form-3, Form-9 as applicable shall be filed under eZfile. | – |

| 7 |

Form 2A

(Filing of altered memorandum and articles of association after approval of the commission for conversion of status of a Company) |

Abolished |

Abolished |

Altered Memorandum & articles of Association shall be filed as an attachment to Form-26 under eZfile. | – |

| 8 |

Form-3 with Appendix

(Return of allotment of shares) |

Form 3

(Return of allotment of shares & Change of more than twenty-five percent in shareholding or membership or voting rights) |

Existing Form 3 and Form 3A have been merged. | eZfile | – |

| 9 |

Form-3 A

(Change of more than twenty-five percent in shareholding or membership or voting rights)

|

Abolished | Merged into Form 3 | – | – |

| 10 |

Form 4

(Intimation about Principal line of business or change therein)

|

Form 4

(Intimation about Principal line of business or change therein) |

No change | Manual | – |

| 11 |

Form-5

(Petition for alteration in Memorandum of Association)

|

Abolished | Abolished | – | – |

| 12 |

Form-6

(Notice of consolidation, division or sub-division of shares, specifying the shares so consolidated, divided or sub-divided or the cancellation of shares) |

Abolished | Merged in Form 7 |

– |

– |

| 13 |

Form-7

(Notice of alteration in share capital) |

Form 7

(Notice of alteration in share capital) |

A combined Form has been developed for existing Form-6 & Form-7. | eZfile | – |

| 14 |

Form-8

(Application for Change of Name of a company)

|

Abolished | The company may file an application with relevant information in LEAP. | eZfile | – |

| 15 |

Form-9

(Notice of the court’s order disallowing / confirming the variations of the rights of holders of/ special class of shares)

|

Abolished | No more required as the company will forward a copy of the order of the High Count to the registrar pursuant to Section 59(4) of the Companies Act. | – | – |

| 16 |

Form-10

(Particulars of mortgage, charge, pledge, etc.)

|

Form 10

(Particulars of registration/modification/satisfaction of mortgage, charge, pledge, etc.)/ Mortgage or charge subject to which property has been acquired

|

A combined Form has been developed for existing Form 10, Form 11, Form 16 & Form 17. | – |

eServices

(Form-10 shall be filed as per existing format till launch of next phase by using the same interface of LEAP)

|

| 17 |

Form-11

(Particulars of mortgage or charge subject to which property has been acquired) |

Abolished | Merged into Form 10 | – |

eServices

(Form-11 shall be filed as per existing format till launch of next phase by using the same interface of LEAP)

|

| 18 |

Form-12

(Register of mortgages, charges, pledge etc., to be maintained by a company) |

Abolished | Converted as Register R-5 | – | – |

| 19 |

Form-13

(Registration of entire series of debentures/ redeemable capital) |

Form 13

Registration of entire series of debentures or redeemable capital / Particular of an issue of redeemable capital/debenture in a series when more than one issue in the series is made. |

A combined Form has been developed for existing Form 13 & Form 14. | – |

eServices

(Form-13 shall be filed as per existing format till launch of next phase by using the same interface of LEAP)

|

| 20 |

Form-14

(Particulars of an issue of redeemable capital / debentures in a series when more than one issue in the series is made) |

Abolished | Merged in Form 13 | – |

eServices

(Form-14 shall be filed as per existing format till launch of next phase by using the same interface of LEAP)

|

| 21 |

Form-15

(Notice of appointment or change of nominee or change in his particulars (for single member company only) |

Abolished | Merged in Form 9 |

– |

– |

| 22 |

Form-16

(Particulars of modification of mortgage, charge, pledge, etc.) |

Abolished | Merged in Form 10 |

– |

eServices

(Form-16 shall be filed as per existing format till launch of next phase by using the same interface of LEAP)

|

| 23 |

Form-17

(Memorandum of complete satisfaction of mortgage, charge, pledge, etc.)

|

Abolished | Merged in Form 10 |

– |

eServices

(Form-17 shall be filed as per existing format till launch of next phase by using the same interface of LEAP)

|

| 24 |

Form-18

(Notice of appointment/ cessation of receiver or manager to be given by the person who obtained an order for appointment of / appointed a receiver or manager) |

Abolished | Abolished. It was just filing of notice of appointment of receiver or manager with the registrar. The company shall furnish the said information manually with concerned CRO. | – |

– |

| 25 |

Form-19

(Notice to be given by receiver /manager on ceasing to act as such) |

Abolished | Abolished. It was just filing of notice to be given by receiver /manager on ceasing to act as such. The company shall furnish the said information manually with concerned CRO. | – | – |

| 26 |

Form-20

(Receiver or manager’s abstract of receipts and payments) |

Abolished |

Abolished as it was filing of receiver’s abstract of Receipt and Payment account with registrar. The company shall furnish the said information manually with concerned CRO. |

– |

– |

| 27 |

Form-21

(Notice of situation of registered office address or any change therein)

|

Form 21

(Notice of situation of registered office address or any change therein / Notice of address where books of accounts are maintained)

|

A combined form has been developed for existing Form 21 and Form 33. | eZfile | – |

| 28 |

Form-22

(Declaration regarding compliance with the conditions of section 19 of the Companies Act, 2017 before commencing business in case of a company issuing prospectus) |

Form 22 (Declaration by a public company before commencing business)

|

A combined form has been developed for existing Form 22 & form 23 merged | Manual | – |

| 29 |

Form-23

(Declaration before commencing business in case of a company filing statement in lieu of prospectus) |

Abolished | Merged into Form 22 |

– |

– |

| 30 |

Form-24

(Notice of rectification of register of members/ directors) |

Abolished |

The form has been abolished. However, it has become part of the regulation and to be filed with necessary information as provided in Regulation-50. The company shall furnish the said information manually with concerned CRO. |

– |

– |

| 31 |

Form-25

(Statutory Report) |

Form 25

(Statutory Report) |

Same Form | Manual | – |

| 32 |

Form-26

(Special Resolution)

|

Form 26

(Special Resolution) |

Same Form | eZfile | – |

| 33 |

Form-27

(Declaration to be submitted to the court by provisional manager/official liquidator) |

Abolished |

To be filed as prescribed under the Court Rules. The company shall furnish the said information manually with concerned CRO. |

– |

– |

| 34 |

Form-28

(Consent to act as director / chief executive) |

Abolished

|

It has become an Appendix to Form 9.

|

– |

– |

| 35 |

Form-29

(Particulars of directors and officers, including the chief executive, secretary, chief financial officer, auditors and legal adviser or of any change therein) |

Form 9

(Particulars of directors and officers, including the chief executive, secretary, chief financial officer, auditors, legal adviser or nominee of Single Member Company) |

A combined Form has been developed for existing Form 15 and Form 29. | eZfile | – |

| 36 |

Form-30

(Notification of particulars of beneficial ownership to the company) |

Abolished | It has become part of the regulation. The officers/shareholders are required to submit necessary information as provided under regulation 63 to the company. | – | – |

| 37 |

Form-31

(Return containing particulars of substantial shareholder/officers for companies’ global register of beneficial ownership)

|

Form 11

(Return containing particulars of substantial shareholder/officers and Companies, for companies’ global register of beneficial ownership) |

A combined form has been developed for existing Form 31 & 32. |

eZfile | – |

| 38 |

Form-32

(Return containing particulars of companies for companies’ global register of beneficial ownership)

|

Abolished | Merged in to Form 11 |

– |

– |

| 39 |

Form-33

(Notice of address where books of accounts are maintained) |

Abolished |

Merged into Form-21 | – | – |

| 40 |

Form-34

(Pattern of Shareholding) |

Form 20 (Pattern of Shareholding) |

Form Number has been changed | Manual | – |

| 41 |

Form-35

(Filing of copy of scheme of amalgamation) |

Form-8 (Filing of copy of scheme of amalgamation) |

Form Number has been changed | Manual | – |

| 42 |

Form-36

(Notice of Dissenting Shareholders) |

Abolished |

It has become part of the regulation-59. The company shall furnish the said information manually with concerned CRO. | – | – |

| 43 |

Form-37

(Information to be furnished in relation to any offer of a scheme or contract involving the transfer of shares or any class of shares in the transferor company to the transferee company) |

Form 23

(Information to be furnished in relation to any offer of a scheme or contract involving the transfer of shares or any class of shares in the transferor company to the transferee company) |

Form Number has been changed |

Manual |

– |

| 44 |

Form-38

(Application for obtaining status of inactive company) |

Abolished |

Converted as an application App-2 | Manual | – |

| 45 |

Form-39

(Application for conversion of status from inactive to active company) |

Abolished |

Converted as an application App-2 | Manual | – |

| 46 |

Form-40

(Public notice to holders of securities of bearer nature issued by a company)

|

Form 14

(Public notice to holders of securities of bearer nature issued by a company) |

Form number changed. No change in the particulars of the existing Form 40. | – | – |

| 47 |

Form-41

(Register containing particulars of holders of securities of bearer nature and particulars of such securities surrendered or cancelled)

|

Form 15

(Register containing particulars of holders of securities of bearer nature and particulars of such securities surrendered or cancelled) |

Form number changed, No change in the particulars of the existing Form 41. | – | – |

| 48 |

Form-42

(Notice to members for providing particulars of ultimate beneficial owners)

|

Form 16

(Notice to members for providing particulars of ultimate beneficial owners) |

Form number changed, No change in the particulars of the existing Form 42. | – | – |

| 49 |

Form-43

(Declaration by member about ultimate beneficial owners)

|

Form 17

(Declaration by member about ultimate beneficial owners) |

Form number changed, No change in the particulars of the existing Form 43. | – | – |

| 50 |

Form-44

(Declaration by member about change of ultimate beneficial owners or particulars thereof.)

|

Form 18

(Declaration by member about change of ultimate beneficial owners or particulars thereof.) |

Form number changed, No change in the particulars of the existing Form 44. | – | – |

| 51 |

Form-45

(Declaration of compliance with the provisions of section 123A of the Companies Act, 2017) |

Form 19

(Declaration of compliance with the provisions of section 123A of the Companies Act, 2017) |

Form number changed, No change in the particulars of the existing Form 45 | eZfile | – |

- Companies (Incorporation) Regulations, 2017

| Sr. No |

Existing Form No.

|

New Form No. in Companies Regulations, 2024

|

Remarks regarding new Forms under eZfile | Mode of Filing (eZfile /eServices/Manual) | |

| After launch of LEAP, following forms would be filed under “eZfile” Portal | After launch of LEAP, following forms would be filed under existing “eService” Portal | ||||

|

52

|

Inc. Form-I

(Application for reservation of name)

|

App-1 (Application for reservation of Name for new incorporation or change of name) | Converted as Application App-1. | eZfile | – |

| 53 |

Inc. Form-II

(Application for company incorporation) |

Form 1 (Application for company incorporation) | Form Number has been changed | eZfile | – |

- Foreign Companies Regulations, 2018

| Sr. No |

Existing Form No.

|

New Form No. in Companies Regulations, 2024

|

Remarks regarding new Forms under eZfile | Mode of Filing (eZfile /eServices/Manual) | |

| After launch of LEAP, following forms would be filed under “eZfile” Portal | After launch of LEAP, following forms would be filed under existing “eService” Portal | ||||

|

54

|

Fnc. Form-I

(Application for reservation of name)

|

App-1 (Application for reservation of Name for new incorporation or change of name) | Converted as Application App-1. | – | eServices

(Fnc. Form-I shall be filed as per existing format till launch of next phase)

|

|

55 |

Fnc. Form-II

(Registration of documents of a foreign company) |

Form 2

(Registration of documents of a foreign company)

|

Form Number has been changed | – | eServices

(Fnc. Form-II shall be filed as per existing format till launch of next phase)

|

|

56

|

Fnc. FORM-III

(Registration of alterations in documents Or details of foreign company)

|

Form 5

(Registration of alterations in documents or details of foreign company) |

Form Number has been changed | – | eServices

(Fnc. Form-III shall be filed as per existing format till launch of next phase)

|

|

57 |

Fnc. Form -IV

(Application for change of name)

|

Abolished | Abolished | – | eServices

(Fnc. Form-IV shall be filed as per existing format till launch of next phase)

|

|

58 |

Fnc. Form-V

(Filing of accounts and related information) |

Abolished | Abolished | – | eServices

(Fnc. Form-V shall be filed as per existing format till launch of next phase)

|

| 59 |

Fnc. Form-VI

(Notice by a foreign company on ceasing to have any Place of business in Pakistan) |

Form 6

(Notice by a foreign company on ceasing to have any place of business in Pakistan) |

Form number has been changed | – | eServices

(Fnc. Form-VI shall be filed as per existing format till launch of next phase)

|

- Companies (Further Issue of Shares) Regulations, 2020

| Sr. No |

Existing Form No.

|

New Form No. in Companies Regulations, 2024

|

Remarks regarding new Forms under eZfile | Mode of Filing (eZfile /eServices/Manual) | |

| After launch of LEAP, following forms would be filed under “eZfile” Portal | After launch of LEAP, following forms would be filed under existing “eService” Portal | ||||

| 60 | Schedule I to the Companies (Further Issue of Shares) Regulations, 2020

|

Form 12

(Circular to be sent to the Members along-with the Offer letter)

|

New Form developed | Manual | – |

- Unlisted companies (Buy-Back of shares) Regulations, 2023

| Sr. No |

Existing Form No.

|

New Form No. in Companies Regulations, 2024

|

Remarks regarding new Forms under eZfile | Mode of Filing (eZfile /eServices/Manual) | |

| After launch of LEAP, following forms would be filed under “eZfile” Portal | After launch of LEAP, following forms would be filed under existing “eService” Portal | ||||

| 61 | No Form

|

Form 27

(Final return for buy-back of shares of unlisted companies)

|

New Form developed | Manual | – |

Received NRA 2023 Summarized Version for DNFBPs, LPLAs, WTCs

Received NRA 2023 Summarized Version for DNFBPs, LPLAs, WTCs

Received email from SECP NRA 2023 Summarized Version for DNFBPs, LPLAs, WTCs What should you do?

In compliance to the NRA-23, the Companies and LLPs are required to collect, verify, and report the beneficial ownership information, without delay. In addition to the above, the Companies and LLPs are also required to maintain and update the beneficial ownership information on a regular basis and ensure its accuracy and completeness

Furthermore, it is utmost essential that all entities comply with the applicable laws and FATF Recommendations/standards on beneficial ownership transparency

Received NRA 2023 Summarized Version for DNFBPs, LPLAs, WTCs ?

You have to report the company beneficial owner.

If you are unable to reply Astro Asscoiates will file the form on behalf of you.If you have any question feel free to contact us.

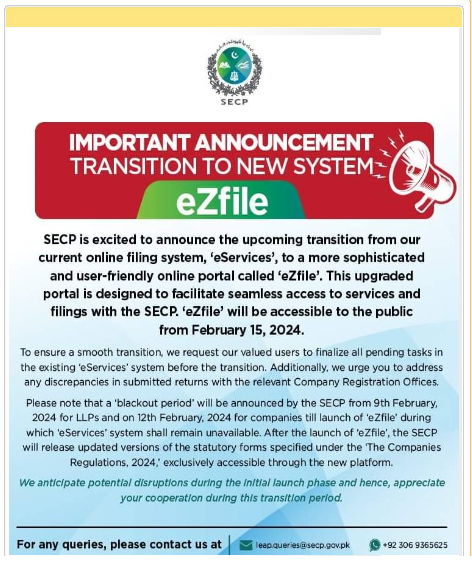

eZfile SECP

SECP is launching a new easy online portal eZfie SECP.New Upgraded portal is designed to facilitate seamless access to services and filing with SECP.eZfile SECP will be accessible to the public from February 15,2024.

If you want to register a company in secp as a Parivate Limited you have to wait till 15th Feb 2024 after this eZfile SECP will operational.All new task and new incorporation will be in eZfile. If any issue feel free to contact us