income tax, sales tax, and federal excise duty Appeals

income tax, sales tax, and federal excise duty Appeals

The Tax Law Amendment Bill 2024, presented by Federal Minister for Law and Justice, Mr. Azam Nazeer Tarar, on 24.04.2024, proposes key changes in how tax appeals are handled in terms of income tax, sales tax, and federal excise duty.

Income tax, sales tax, and federal excise duty Appeals that Under the current system, the Commissioner IR Appeals handles a broad spectrum of tax-related appeals. However, with the introduction of this bill, their jurisdiction will be limited to dealing with income tax appeals up to Rs20 million, sales tax appeals up to Rs10 million, and federal excise duty appeals up to Rs5 million. Appeals exceeding these amounts will now be directly heard by the Appellate Tribunal Inland Revenue (ATIR).

This proposed redirection is part of a broader effort to expedite the decision-making process in tax-related matters, ensuring that cases involving larger sums are handled by the ATIR, which is equipped to deal with more complex and higher-value disputes. As outlined in the bill, all cases currently pending before the Commissioner that exceed these thresholds will be transferred to the ATIR, with a stipulated decision period of 6-months from the date of transfer.

Further, the bill seeks to enforce stricter timelines for the escalation of cases from the Tribunal to the High Court, mandating that such appeals and references be filed within 30-days of receiving the order, with the High Court required to make a decision within 6-months.

The legislative intent behind these reforms is clear. The minister noted that there is currently a staggering Rs2.7 trillion tied up in pending tax cases across various forums, including the Commissioner’s Appeals, Appellate Tribunals, and higher courts. By reallocating the jurisdictional responsibilities and setting firm timelines, the government aims to alleviate the bottleneck in the system and free up a significant amount of resources currently stalled in litigation.

This move has been framed as part of a larger strategy to not only streamline the tax appeal process but also to broaden the tax base, a critical step towards strengthening the national economy. The government has expressed its commitment to transparency in this process, inviting suggestions from opposition parties and other stakeholders, and has consulted with the Tax Bar Association in the drafting of the bill.

However,as per income tax, sales tax, and federal excise duty Appeals bill the proposed changes have not been without criticism. Opposition Leader Mr. Omar Ayub has suggested that the bill should be deliberated further in the Finance Committee, indicating that there may be reservations regarding the specifics of the jurisdictional limitations and the potential impact on taxpayers’ rights to a fair appeal process.

As the bill moves through the legislative process, income tax, sales tax, and federal excise duty Appeals,it will be important to observe how these discussions evolve and what amendments might be proposed to address the concerns raised by the opposition and tax experts alike. If passed, this amendment could represent a pivotal shift in Pakistan’s approach to tax litigation, potentially setting a precedent for future reforms in fiscal governance.

How to apply income tax, sales tax, and federal excise duty Appeals?

What the process of income tax, sales tax, and federal excise duty Appeals?

What is new process of income tax, sales tax, and federal excise duty Appeals?

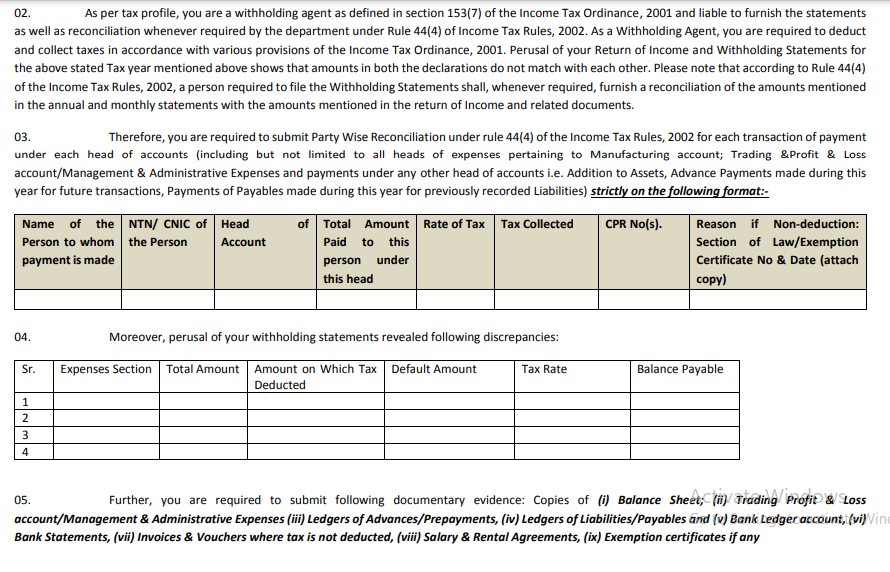

Notice under Rule 44(4) of the Income Tax Rules 2002 What you do?

Notice under Rule 44(4) of the Income Tax Rules 2002

Notice under Rule 44(4) of the Income Tax Rules 2002 you should reply within due date with required details.They Sent you on the basis of said year after tax filing.FBR saw your tax retrun where you have declared purchases etc.

What if you no reply

They will send you another notice where they will mention amount of purchase salaries all exepnse.After given three opportunities they will finalize tax liability.

What if you cannot reply Notice under Rule 44(4) of the Income Tax Rules 2002 then you can contact us