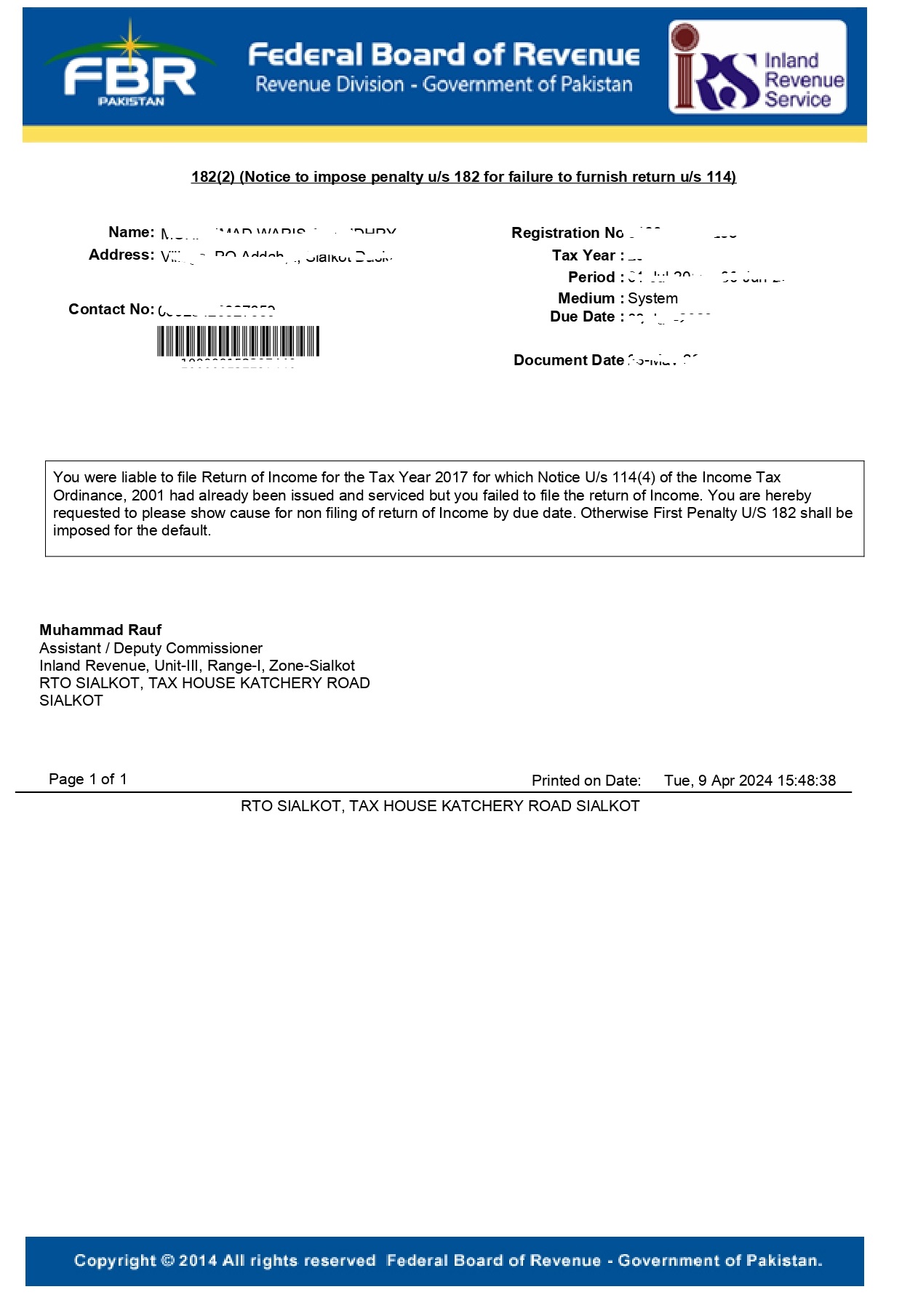

182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)

182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)

You were liable to file Return of Income for the Tax Year 2023 for which Notice U/s 114(4) of the Income Tax

Ordinance, 2001 had already been issued and serviced but you failed to file the return of Income. You are hereby

requested to please show cause for non filing of return of Income by due date. Otherwise First Penalty U/S 182 shall be imposed for the default.

Why i received 182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)?

After the due date of filing time was given to file tax retrun within notice due date but you failed to file your tax retrun so you got the notice.

What should i do if i got 182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114) ?

Last oppurtunity given you shuld file within show cause notice period.

114(4) (Notice to file Return of Income for complete year)

114(4) (Notice to file Return of Income for complete year) What should you do?

- You were required to furnish your income tax return for the tax year 2023 in view of sub-clause

(vii) of clause (b) of sub-section (1) of section 114 of the Income Tax Ordinance, 2001.FBR database,however depicts that you have not filed your income tax return. In view of the above, you are hereby required under sub-section (4) of section 114 of the said Ordinance to file your income tax return for the

said tax year within thirty (30) days of receipt of this notice. - Please note that failure to comply with any of the terms of this notice may result in ex parte assessment under section 121 of the said ordinance, and may also render you liable to a penalty undersub-section (1) of section 182 of the said Ordinance.

- What should you do if received 114(4) (Notice to file Return of Income for complete year)

You should file your tax retrun with in due date otherwise they will send you Proceeding u/s 114B of Income Tax Ordinance, 2001.

If you want to file tax retrun we are the best tax consultant in Islamabad.You may contact us