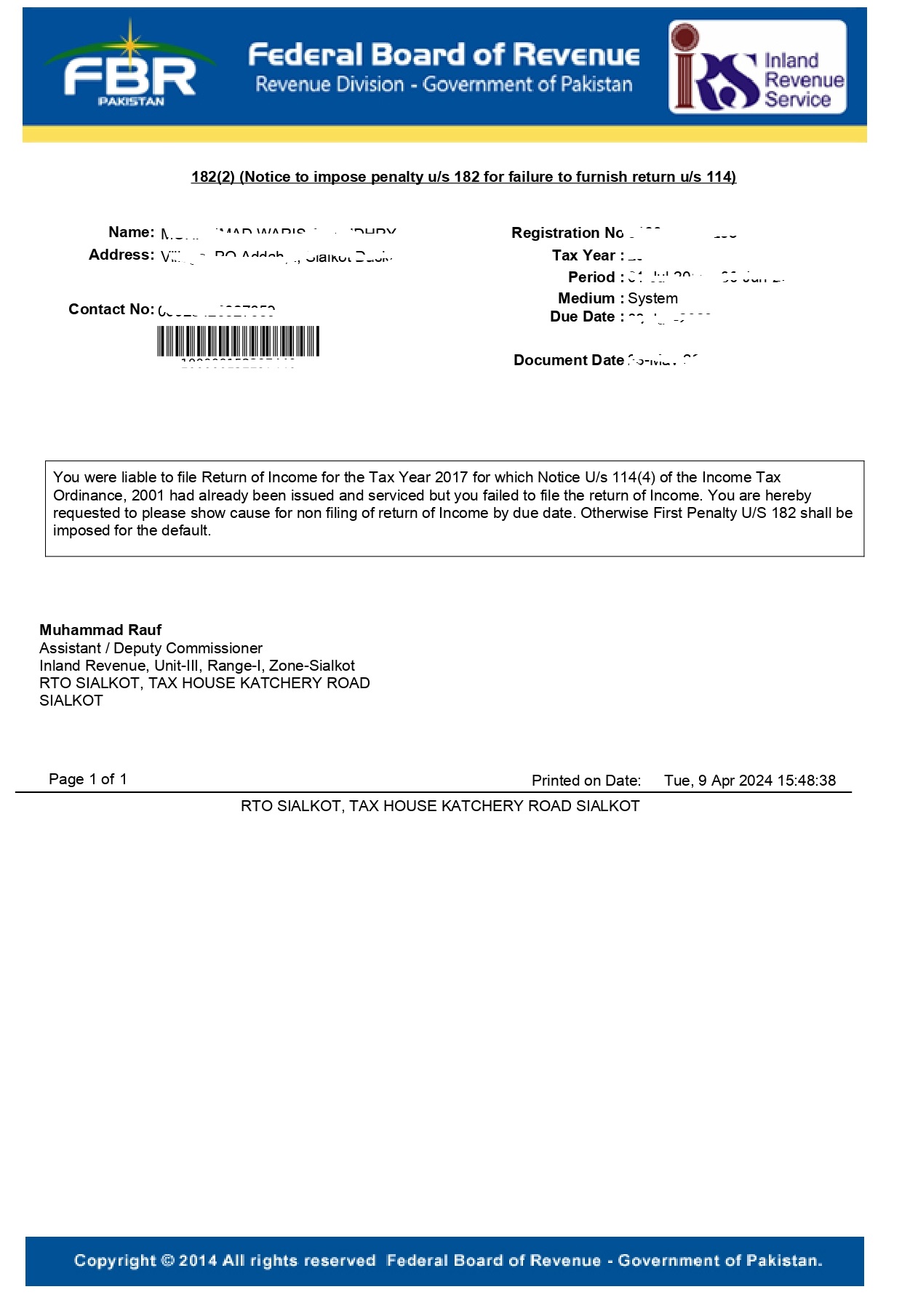

182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)

182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)

You were liable to file Return of Income for the Tax Year 2023 for which Notice U/s 114(4) of the Income Tax

Ordinance, 2001 had already been issued and serviced but you failed to file the return of Income. You are hereby

requested to please show cause for non filing of return of Income by due date. Otherwise First Penalty U/S 182 shall be imposed for the default.

Why i received 182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)?

After the due date of filing time was given to file tax retrun within notice due date but you failed to file your tax retrun so you got the notice.

What should i do if i got 182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114) ?

Last oppurtunity given you shuld file within show cause notice period.